While in the world of Windows there is a great deal of software for businesses to choose from to look after their accounts, the choices on RISC OS are very limited in comparison. In recent years, the choices have become even more limited as the operating system (and underlying hardware) has moved on, and older software has become unsupported and is no longer updated by the original developers.

One such package, however, has been given a new lease of life – Prophet, originally written by Quentin Pain of Apricote Studios (now Accountz), is now available from Elesar Ltd in an updated form that is fully 32-bit compatible, and suitable for modern RISC OS platforms.

Originally brought out in 1991, Quentin’s last release of the software was version 3.92 in April, 2003. Elesar’s initial update to the software brings it up to version 3.94, and incorporates a number of changes:

- The software is now compatible with all machines running RISC OS 3 and above with 4MB or more of RAM, so internal platform checks have been removed – as has any legacy RISC OS 2 support code.

- It is now fully 32-bit compatible, so can be used without Aemulor.

- Menus and buttons have been enlarged in line with Style Guide requirements, and new icon sprites have been added for RISC OS 4 and 5.

- Other issues that have been dealt with include the software being fixed to so that it no longer writes to the system timer, and redefined hotkeys to avoid clashes with operating system hotkeys.

The software’s manual – which stands at a healthy 262 pages – has also been updated with new screen captures and up to date text.

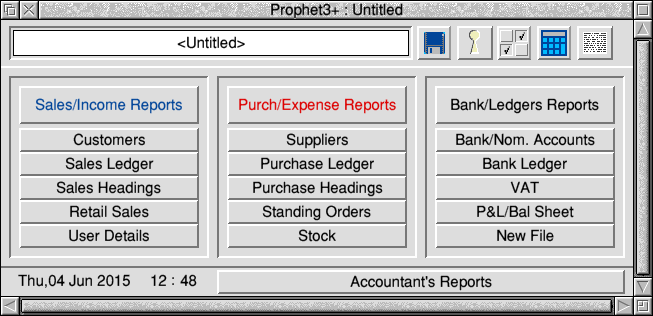

Prophet is a comprehensive accounts package, with a feature set comparable with many more expensive packages on other platforms, including:

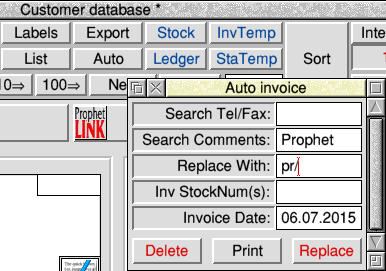

- Full sales ledger facilities, including a customer/client database, invoicing (including automatic/recurring invoices), support for retail sales for a shop or retail counter.

- Full purchase ledger facilities, including a supplier database, and the ability to raise purchase orders against suppliers.

- Stock management, with facilities to print custom labels for stock keeping units (SKUs) you hold.

- Bank and cash account management, with automatic recurring entries (for standing orders and similar), and bank reconciliations.

Some aspects of the software are designed around UK requirements, but can be configured to suit other locales. For example, the sales tax is called VAT (more details on which below), and the default rate is 20% – but these can be changed if necessary.

The software uses a separate file for each set of accounts being maintained, which means it includes support for multiple companies straight out of the box. Templates for printed documents, such as invoices, can be fully customised, and the software is also able to produce fully journalled reports for the accountant to produce year-end accounts and submit them.

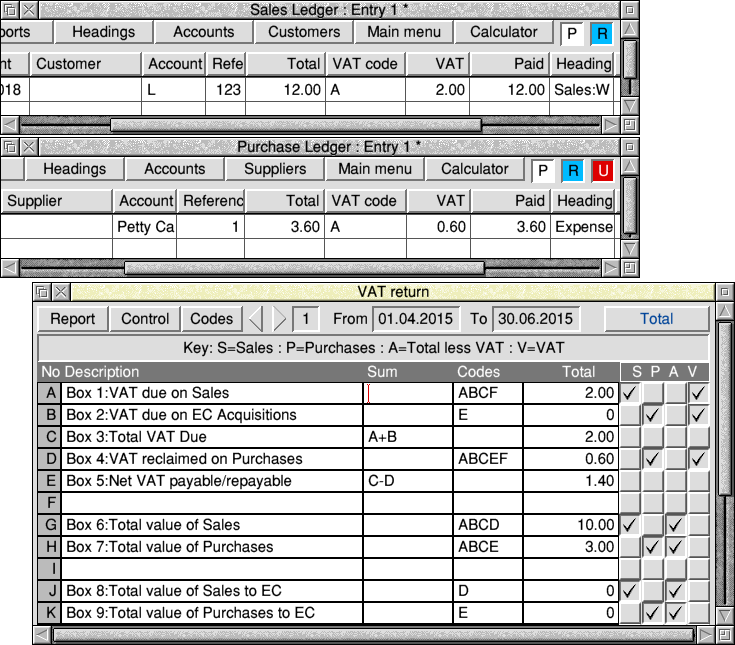

Slightly more frequently, the software can also compute VAT returns – and this is something I discussed with Elesar’s Rob Sprowson due to changes that are being introduced by HM Revenue and Customs (HMRC) from April 2019.

Under the current system, VAT returns can be submitted directly from within accounts software if the package has the facility to do so, or they can be submitted manually by logging in to the relevant part of HMRC’s website and the necessary figures keyed into a form. Prophet is currently unable to perform the submission, so Prophet users have to use the manual process.

However, from April 2019, as part of the Making Tax Digital (MTD) programme, businesses with turnovers above the threshold for VAT registration (currently £85,000) must use MTD compliant software to submit their VAT returns – there will be no manual option.

With that in mind, Rob told me that he has registered with HMRC and has been allocated a developer key. He is currently looking into what’s needed to make VAT and other submissions from within a software package, rather than the user doing it manually, with a view to either building the facilities into the main application, or providing it as a separate plug-in for those who need it.

Previously costing £119 plus VAT from Apricote, the software is now available for £81.00 plus VAT (£97.20 inclusive) for a new licence, but users of any earlier 3.xx version can upgrade for £57.00 plus VAT (£68.40) – prices that include future minor updates to the 3.xx series. It can be ordered from Elesar’s product page, or offline ordering is possible by sending an email to sales@elesar.co.uk.